Record Keeping For Tax Business . Registers, listings) and not source documents such as receipts and invoices. under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. Under the srk, qualifying small businesses only need to keep business records (e.g. your company must maintain proper records of its financial transactions and retain the source documents, accounting records. 5 things to know about record keeping. The inland revenue authority of singapore (iras) requires companies to maintain. The law requires every business to keep proper accounts and records. in order to make record keeping easier for small businesses, iras has simplified record keeping requirements (srk). You are legally required to keep records of all transactions relating to your tax, superannuation and.

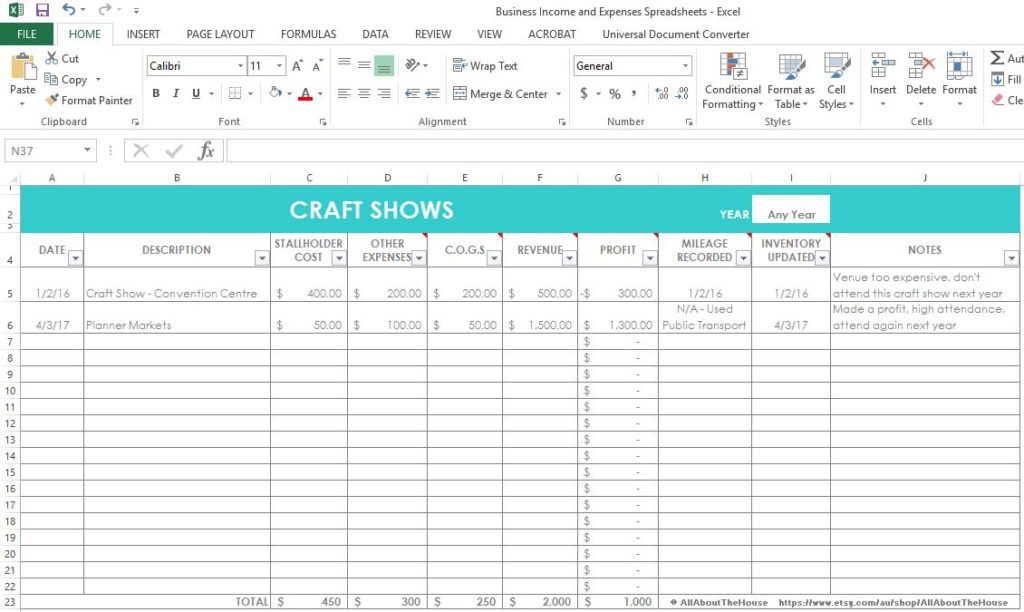

from www.allaboutthehouseprintablesblog.com

under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. Registers, listings) and not source documents such as receipts and invoices. The law requires every business to keep proper accounts and records. 5 things to know about record keeping. in order to make record keeping easier for small businesses, iras has simplified record keeping requirements (srk). Under the srk, qualifying small businesses only need to keep business records (e.g. The inland revenue authority of singapore (iras) requires companies to maintain. your company must maintain proper records of its financial transactions and retain the source documents, accounting records. You are legally required to keep records of all transactions relating to your tax, superannuation and.

Simple spreadsheets to keep track of business and expenses for

Record Keeping For Tax Business under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. The law requires every business to keep proper accounts and records. in order to make record keeping easier for small businesses, iras has simplified record keeping requirements (srk). under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. Registers, listings) and not source documents such as receipts and invoices. The inland revenue authority of singapore (iras) requires companies to maintain. your company must maintain proper records of its financial transactions and retain the source documents, accounting records. You are legally required to keep records of all transactions relating to your tax, superannuation and. Under the srk, qualifying small businesses only need to keep business records (e.g. 5 things to know about record keeping.

From www.allaboutthehouseprintablesblog.com

Simple spreadsheets to keep track of business and expenses for Record Keeping For Tax Business Under the srk, qualifying small businesses only need to keep business records (e.g. your company must maintain proper records of its financial transactions and retain the source documents, accounting records. Registers, listings) and not source documents such as receipts and invoices. 5 things to know about record keeping. The inland revenue authority of singapore (iras) requires companies to maintain.. Record Keeping For Tax Business.

From templates.rjuuc.edu.np

Record Retention Policy Template Record Keeping For Tax Business Registers, listings) and not source documents such as receipts and invoices. 5 things to know about record keeping. The law requires every business to keep proper accounts and records. in order to make record keeping easier for small businesses, iras has simplified record keeping requirements (srk). under the income tax act, a company is required to keep proper. Record Keeping For Tax Business.

From www.hss-ca.com

How Long Do I Have to Keep My Business Tax Records? Hogg, Shain & Scheck Record Keeping For Tax Business your company must maintain proper records of its financial transactions and retain the source documents, accounting records. under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. The law requires every business to keep proper accounts and records. You are legally required to keep records of all. Record Keeping For Tax Business.

From www.freedomca.co.nz

Mastering RecordKeeping Tips for Keeping Your Finances Organized Record Keeping For Tax Business The law requires every business to keep proper accounts and records. Registers, listings) and not source documents such as receipts and invoices. your company must maintain proper records of its financial transactions and retain the source documents, accounting records. 5 things to know about record keeping. The inland revenue authority of singapore (iras) requires companies to maintain. You are. Record Keeping For Tax Business.

From db-excel.com

Record Keeping Spreadsheet Templates 1 — Record Keeping For Tax Business Under the srk, qualifying small businesses only need to keep business records (e.g. in order to make record keeping easier for small businesses, iras has simplified record keeping requirements (srk). The law requires every business to keep proper accounts and records. under the income tax act, a company is required to keep proper business records for a minimum. Record Keeping For Tax Business.

From db-excel.com

Record Keeping Template For Small Business And Bookkeeping Records Record Keeping For Tax Business Under the srk, qualifying small businesses only need to keep business records (e.g. under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. The inland revenue authority of singapore (iras) requires companies to maintain. in order to make record keeping easier for small businesses, iras has simplified. Record Keeping For Tax Business.

From reliablebookkeepingservices.com.au

What is the Importance of RecordKeeping for a Small Business? Record Keeping For Tax Business The inland revenue authority of singapore (iras) requires companies to maintain. The law requires every business to keep proper accounts and records. 5 things to know about record keeping. Under the srk, qualifying small businesses only need to keep business records (e.g. You are legally required to keep records of all transactions relating to your tax, superannuation and. your. Record Keeping For Tax Business.

From www.etsy.com

Financial Record Spreadsheet Sales and Expense Tax Etsy Record Keeping For Tax Business Under the srk, qualifying small businesses only need to keep business records (e.g. in order to make record keeping easier for small businesses, iras has simplified record keeping requirements (srk). your company must maintain proper records of its financial transactions and retain the source documents, accounting records. under the income tax act, a company is required to. Record Keeping For Tax Business.

From www.dvphilippines.com

6 Best RecordKeeping Practices for Every Businesses Record Keeping For Tax Business The inland revenue authority of singapore (iras) requires companies to maintain. Registers, listings) and not source documents such as receipts and invoices. 5 things to know about record keeping. your company must maintain proper records of its financial transactions and retain the source documents, accounting records. The law requires every business to keep proper accounts and records. in. Record Keeping For Tax Business.

From www.pinterest.com

Farm Record Keeping Excel Template New Free Farm Record Keeping Record Keeping For Tax Business You are legally required to keep records of all transactions relating to your tax, superannuation and. The inland revenue authority of singapore (iras) requires companies to maintain. Under the srk, qualifying small businesses only need to keep business records (e.g. your company must maintain proper records of its financial transactions and retain the source documents, accounting records. under. Record Keeping For Tax Business.

From wealthfactory.com.au

Importance Of Record Keeping In Small Business » Wealth Factory Record Keeping For Tax Business The law requires every business to keep proper accounts and records. Under the srk, qualifying small businesses only need to keep business records (e.g. You are legally required to keep records of all transactions relating to your tax, superannuation and. under the income tax act, a company is required to keep proper business records for a minimum period of. Record Keeping For Tax Business.

From www.hawkinsash.cpa

Record Retention Schedule Hawkins Ash CPAs Record Keeping For Tax Business your company must maintain proper records of its financial transactions and retain the source documents, accounting records. under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. You are legally required to keep records of all transactions relating to your tax, superannuation and. The inland revenue authority. Record Keeping For Tax Business.

From jaineqlouisette.pages.dev

Irs Business Record Retention Guidelines 2024 Mab Charlene Record Keeping For Tax Business in order to make record keeping easier for small businesses, iras has simplified record keeping requirements (srk). Under the srk, qualifying small businesses only need to keep business records (e.g. your company must maintain proper records of its financial transactions and retain the source documents, accounting records. The inland revenue authority of singapore (iras) requires companies to maintain.. Record Keeping For Tax Business.

From www.etsy.com

Tax Deduction Log Printable Tax Purchase Record Tax Etsy Record Keeping For Tax Business your company must maintain proper records of its financial transactions and retain the source documents, accounting records. under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. The inland revenue authority of singapore (iras) requires companies to maintain. 5 things to know about record keeping. You are. Record Keeping For Tax Business.

From www.patriotsoftware.com

How Long to Keep Payroll Records Retention Requirements Record Keeping For Tax Business The law requires every business to keep proper accounts and records. in order to make record keeping easier for small businesses, iras has simplified record keeping requirements (srk). The inland revenue authority of singapore (iras) requires companies to maintain. under the income tax act, a company is required to keep proper business records for a minimum period of. Record Keeping For Tax Business.

From www.pinterest.com

Small Business Tax Spreadsheet Small business bookkeeping, Small Record Keeping For Tax Business under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. The inland revenue authority of singapore (iras) requires companies to maintain. You are legally required to keep records of all transactions relating to your tax, superannuation and. 5 things to know about record keeping. Under the srk, qualifying. Record Keeping For Tax Business.

From www.jmbfinmgrs.com

Record Retention Guidelines for Business Owners JMB Financial Managers Record Keeping For Tax Business You are legally required to keep records of all transactions relating to your tax, superannuation and. under the income tax act, a company is required to keep proper business records for a minimum period of 5 years. Registers, listings) and not source documents such as receipts and invoices. The law requires every business to keep proper accounts and records.. Record Keeping For Tax Business.

From db-excel.com

Self Employed Record Keeping Spreadsheet Spreadsheet Downloa free Record Keeping For Tax Business 5 things to know about record keeping. your company must maintain proper records of its financial transactions and retain the source documents, accounting records. The law requires every business to keep proper accounts and records. You are legally required to keep records of all transactions relating to your tax, superannuation and. The inland revenue authority of singapore (iras) requires. Record Keeping For Tax Business.